Innovating for Efficiency, Sustainment, or Empowerment

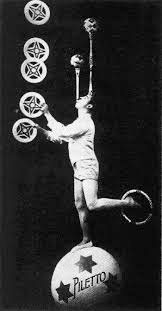

There are new value propositions … and then there are new value propositions. Strategic innovation is a balancing act (see our September issue), in which leaders juggle personalities and roles, ration time and resources, and weigh risk/reward factors among the projects that live within their innovation portfolios.

On that last one, it’s useful to think of projects (or even overall company strategies) in relation to one or more « platforms for growth »:

- Platform 1 – Initiatives that extend your present business performance, and capture the full potential of current value propositions.

- Platform 2 – New value propositions that are offered and supported within current business models.

- Platform 3 – Entirely new businesses and business models that emerge from game-changing, disruptive concepts.

Clayton Christensen lays out another way of thinking about innovation types in a recent feature in the New York Times¹. He outlines three types:

- Empowering – Innovations that transform complex, high-cost products into simpler, cheaper ones for mass markets. Examples: the Ford Model T and the personal computer.

- Sustaining -Innovations that replace older product models or versions. Example: hybrid cars.

- Efficiency – Innovations that reduce the cost of production and/or distribution. Example: Nucor’s oft-cited steel mini-mills.

Christensen, a Harvard Business School professor and winner of the 2011 Thinkers50 Innovation Award, analyzes the relative balance of these three types of innovation and their impact across the economy as a whole. Efficiency innovations streamline processes, usually reduce the number of jobs, and free up capital – and they can provide competitive advantage. Sustaining ones enliven the economy, but the effect on capital and revenue is neutral overall. Empowering innovations create new markets and new jobs, and they require capital investment.

« As long as empowering innovations create more jobs than efficiency innovations eliminate, » Christensen says, « and as long as the capital that efficiency innovations liberate is invested back into empowering innovations, we keep recessions at bay. » He postulates that the balance is out of whack at present: our business metrics and incentives focus on the efficiency of capital, and not on investment for the type of growth that can come from empowering innovations.

This thinking and these categories can obviously apply to individual companies, too. Efficiency innovations, including methodologies like the Toyota Production System, increase competitiveness and can lead to breakthrough ideas and new ways of working. They can certainly be the engine that sets your company on the path to gaining competitive advantage and capturing market share. They also emancipate capital. How does your company reinvest capital from efficiency innovations for long-term growth? In more efficiency-related innovations? In sustaining innovations (compare with our Platform 2 description above)? Or in empowering ones (compare with our Platform 3 above)?

There is no one right answer that will work for every company. Much depends on your industry and your current business situation. But if you are thinking only of efficiency, you could be living within a narrow vision of your company’s potential value propositions and squeezing its future. Actively considering and managing the balance in your innovation portfolio, and your company’s specific strategy for growth, should be job one.

- « A Capitalist’s Dilemma, Whoever Wins on Tuesday, » by Clayton Christensen.

(New York Times, 11/4/12, Sunday Business, p. 3.)